In the age of easy internet accessibility many self employed people are winning big with home based earners like financial day trading. I was intrigued by the idea not only from a risk point of view but also from an ethical position.

So I watched the BBC series Million Dollar Traders in which a group of novices try to outsmart the stock market by short selling stocks. They have the opportunity to earn bonuses if they profit as a team.

The results are fascinating but the warning signs are clear.

A pile of cash is provided by retired millionaire hedge fund manager Lex Van Dam and the project is overseen under the watchful eye of right hand man Anton Kreil, a 29 year old retired trader doling out $1 million to the 8 wannabe traders.

It all takes place in a London office. After a round of interviews and two weeks of crash course classroom sessions from leading City experts, the traders are let loose on the markets.

Million Dollar Traders (BBC, 2009)

Originally broadcast in 2009, and spanning a 2 month period, this is a televised recreation of the famous Turtle Traders experiments devised by Richard Dennis, a famous commodities speculator of the 1980’s.

The embedded YouTube video below is a playlist of all three episodes, or you can click the links to watch individual episodes.

Episode 1: Make Me a Trader

Episode 2: Profit and Loss

Episode 3: Traders

Training

Everyone in the group is initially given £25,000 to make trades. Certain individuals are later awarded more if they demonstrate good ideas and makes good trades.

There is a classroom session at the beginning

The two weeks of training are edited down to about 2 minutes but everything is covered:

- Generating ideas/strategies

- Phoning a broker and placing a trade

- Market analysis techniques

- Trading psychology

These crash course sequences are shown fleetingly in the series but the clips are available on Lex Van Dam’s website.

Be warned, his site is very slow loading and badly designed, so that link is a little frustrating on a slow connection. Also, please don’t go signing up for whatever day trading “system” he’s selling if you don’t know what you’re getting into.

General Thoughts on the Series

Overall I enjoyed the series and think television programmes like this should be shown more.

This WAS the world’s first hedge fund staffed by beginners and this TV show IS over 5 years old. The banking crisis also hit during filming, making trading conditions particularly difficult.

Even if you have no intention of becoming a trader, I recommend you watch this because it’s interesting and insightful. Normally business reality TV annoys me because of the pandering to mainstream BBC1 audiences.

If business is to be properly on television the producers should always reign in the drama and make sure there is a balanced view. While there are personality clashes and definitely tears, Million Dollar Traders was by no means Big Brother or The Apprentice.

Let’s talk about Lex.

Lex Van Dam

Retired millionaire Lex Van Dam has 15 years of City trading on his watch.

He is a straight talking no nonsense if-you-don’t-like-it-piss-off sort of a chap we see a lot of on reality business TV.

Via numerous phone calls with Anton and occasional visits to the office, Lex lays down the law and berates those undermining the team.

“I don’t want people pissing my money away” he asserts in a talking head cutaway.

What bugged me was the jeopardy that started to unfold as Lex explained he is “taking a risk” and making “the biggest gamble of his life”.

That bit made me frown and shake my head.

One of the first rules of the trading game is being able to afford to lose, and I can tell this guy has plenty of money to spare. He is not stupid enough to place himself in a weak position for the sake of entertainment and his own curiosity.

A bit more research revealed he is (or was) selling trading education courses from his website, so I’m guessing this series served as a springboard and a bit of wraparound content to promote his paid stuff.

Maybe he funded the production of this BBC series as a sort of advert masquerading as “content” to promote his paid training systems and software?

Short Selling / Long Selling

The tactics shown in the series are “short selling” strategies. This is the classic “hedge your bets” approach to protect against uncertain trading positions.

Short selling revolves around borrowing, selling and buying back shares. It depends upon share prices going down.

Long selling is where you invest and hope the stocks increase in price. Think Warren Buffet.

- Short selling – selling a stock you don’t own, waiting for the price to drop and buying it back cheaper.

- Long selling – selling a stock after buying it yourself and waiting for the value to slowly increase.

Eight Novices

There were apparently two other members of the team who quit right at the beginning and as such we never see them in the programme.

As a viewer, we are introduced to the eight participants.

Mike – Former soldier

Cool, calm, collected

“I’ve done a long stint in Afganhistan and I thought, can I do this again? I maybe had my time of selfless commitment. Now I just want to earn some filthy lucre!”

An ex army major, attracted to the idea of trading, perhaps due in part to his disciplined soldiering lifestyle, Mike is the first to impress in the interview and be offered a spot.

Initially he is reluctant to make trades but studies a particular hedging strategy that could pay off big.

Unfortunately it doesn’t work out, but Anton isn’t angry.

In fact, the feedback is that the strategy was one in which it “could have gone a little bit wrong but could have gone massively right. It just went a little bit wrong.”

Undeterred, Mike continues to coolly plot much in the spirit of how an army commander would, using his best judgement to play chess with the resources available.

Driven, focussed, direct and unemotional, he shows a particular interest in arms and weapons manufacturers, taking advantage of political instability and war zones.

He argues that “one man’s dictator is another man’s freedom fighter”.

So if people are marked for death, he makes money. Hmmm.

This rubbed at least one other team member up the wrong way.

Sam – Environmentalist

Passionate, caring, barefoot

“A good trader has to have such a good idea of what is happening in the world, be aware of the wars that are going on… The only focus is on the financial aspect of it and that’s a real problem.”

It was interesting that Lex and Anton agreed to tolerate the presence of an “ethical” trader as part of their experiment.

He does indeed represent a cross section of society who are interested in making money without hurting someone else to achieve their objectives.

Sam walked around the office unshaven and barefoot, sipping what I imagined was fair trade tea and nibbling what looked like something vegan.

There was an interesting discussion between him and Mike, who had retorted something to the effect of “It’s a cruel world” when challenged over his position on weapons trades.

Sam is the sort of guy who might be better off taking a leaf from Warren Buffet’s book and getting involved in something long term as an investor.

He is obviously interested in knowing if he could be a responsible capitalist so maybe the quick, morally questionable methods are not suited to him.

Amit – Shopkeeper

Hardworking, earnest, naive

“I want to find out more and see if I can cope with it, see if I can understand the subject a bit more.”

At 30 years old he has spent the majority of his life working in his parent’s business, or, in his own words “selling mars bars and tea bags”.

It is not a particularly exciting career and so he wants to explore trading.

Amit relates his desire to have an opportunity to make serious cash for his parents so they can “just chill out” and no longer have to worry about work.

From the beginning he seems more interested in the idea of being a trader and the supposed lifestyle associations.

His caution and/or nerves seem to get the better of him in the trading office, resulting in very few trades and basically no portfolio.

One thing worth knowing about Amit, is that when he was 19, he played the markets from his bedroom and got “badly burned” to the tune of £25,000.

Perhaps some people should learn their limitations when it comes to playing with money?

Whether he has a true aptitude for doing the work to support his ambition is revealed later in the series.

Simon – Retired IT engineer

Technical, curious, frustrated

“You’re trying to predict the future, for heaven’s sake!”

This bloke is somewhere in his late 60’s, having come from a cushy office background working for IBM as a computer technician.

He frustrates Anton from the get go and seems to have a numb, hedonistic attitude to trading, pottering around with a faint smile on his face, chatting, making cups of tea, eating breakfast cereal and not appearing to take anything seriously.

Simon later vocalises his frustrations toward the volatility/unpredictable nature of the markets.

He compares it by contrast to the last forty years of his life doing a job in which you get out more or less what you put in.

In programming it is fairly predictable and I can relate to some of this, but his flippant view of the world annoys me.

He ends up leaving the office voluntarily after he realises he cannot succeed at this game.

At least he is honest with himself.

Cleo – Former vet

Driven, passionate, unstable

“Money is a drive for me. I’d be lying if I said it wasn’t.”

Cleo is a former vet working in her parent’s business. Because she does not feel entitled to the success her parents have created she wants to make her own way in the world

However, cracks emerge as the series progresses and it looked as though she was trying to have her cake and eat it.

She reminds me of Jo Cameron in the second series of the UK Apprentice.

She has the emotional range of extreme confidence to total meltdown and constant crying. By the end of the series I regarded her as graceless in both defeat and victory.

Her main trading mistake is that she is not actually trading.

There are few trades made at all and the ones she does make are cautious and under the pressure of constantly second guessing. Endlessly pursuing the “perfect trade” frustrates Anton and he tells her this during a meeting with Lex.

This makes her cry.

Like Amit, because of the lack of trades, Cleo simply does not build a portfolio to hedge risk.

Emile – Fight promoter

Thrillseeking, emotional, philosophical

“It’s about validation. I want to prove that maybe I can be a trader too.”

When the passionate fighting promoter Emile is first introduced I automatically assumed he would be the ideal candidate as a City trader.

Living off the adrenaline of day to day office life seems ideally suited considering his background.

Rather, he seems to be quite the philosopher and remarks that however many graphs/charts you study, the trades you make are based on how you feel at the time.

It made me see trading as glorified gambling, maybe like playing Poker.

Likewise, a business plan is just a collection of assumptions that may or may not work out in your favour.

Emile, being single minded and passionate (not to mention morally decent) clashes with Anton in his defence of Cleo and argues there should be a place for honesty, morals, values and principles.

Anton argues to the contrary.

Both sides raise good points and it’s hard to choose sides given the context in which they are making the money.

Anton, looking like and almost sharing the same attitude as Al Swearengen in HBO’s Deadwood, gives Emile a few curveballs laced with years of hard-nosed trading wisdom.

“If you watch every tick, you’ll trade like a dick”

Whenever Emile has an objection, Anton throws a casual uncompromising retort, just like the Swearengen character.

“So kill the cocksucker”

Caroline – Entrepreneur/single mother

Smart, successful, level-headed

“The skills I’ve gained – self control, stamina, determination, a real desire for business success – are going to work incredibly well in the trading arena.”

This lady is a mother of two, clearly a hard worker and very level headed. She rarely gives any display of emotion and manages to get along well with everyone in the office.

She also makes some excellent trades.

In fact, she does so well that at the end Lex personally congratulates her and holds her up as a shining example.

As impressive as she is, Caroline chooses not to become a trader because she makes it clear her children are her priority.

She is an entrepreneur at heart and goes on to start up another business.

I’d like to know more about the qualities she possesses as well as the trades she actually made.

She displays the classic qualities of an entrepreneur because she enters an area of business she hasn’t been involved in before, learns fast, makes money, then exits without leaving a mess.

I wonder if her experience with business in general has given her those “know a little about a lot” characteristics a lot of successful people have?

Ohi – Economics student

Unassuming, diligent, student

“The nature of trading is that money can come and go in such a flowing way, that it’s almost like a living, breathing thing.”

As a 20 year old university student studying for an economics and maths degree, it would seem Ohi already has an understanding of what he is getting himself into.

He is much like Caroline in that he mainly keeps to himself and gets on with his work.

There are no displays of extreme emotion and we do not hear much from him. By the end of the series he is one of the remaining three who have made money to the delight of Anton and Lex.

We really don’t hear much from him throughout the series.

Quitters Don’t Win

As mentioned earlier, Simon is the first to leave of his own accord.

I was glad, because the way Simon sheepishly approaches Anton in his office reminds me of Mark Corrigan from TV’s Peep Show.

If you’ve seen the programme, imagine how Mark sheepishly pops in and out of Alan Johnson’s office to nervously report some failure.

Simon even SOUNDS like Mark! If you’ve already watched the series, close your eyes and listen. It is uncanny.

Another comparison I can make between Simon and fictional TV characters is E. B. Farnum in the HBO series Deadwood.

Yes, another Deadwood reference in the same post!

You just need to imagine Farnum approaching the ruthless Al Swearengen, cap in hand, apologising with buffoonish seriousness for yet another business mishap.

Delusion & Disappointment

Cleo is shown the door by an exasperated Lex, with Anton (and probably most of the viewers) in agreement. She tearfully fights tooth and claw to remain but it is obvious she doesn’t have what it takes.

It is predicted Emile will become angry and walk out after learning of this treatment, because by this time the two have bonded – a real mistake for serious traders.

Walking Out

Lex and Anton have high hopes for Emile but in the end they are proved right when he becomes upset over the treatment of Cleo and others in the office.

Emile walks out, prompting three other people failing to make money to also pack up and leave.

“You cannot make yourself in another’s image,” says Emile.

This show of solidarity actually results in a win/win situation because it results in the best three people on the team remaining and the rest walking.

The losers were hemorrhaging money and dragging down the overall average of the team.

They had to go.

After the departure of Cleo, Emile, Sam and Amit, Lex remarks the people who don’t make money will always look for excuses because they’re “hurting” due to the lack of success.

“In trading you want to make money, not friends.” He says this in a very matter-of-fact way.

“Some people are interested in the City trading lifestyle but they don’t want to do the work,” he remarks on another occasion.

This should serve as a warning if you think you have what it takes to trade on the open market.

Wisdom of Lex

- “You have to take risks to make money.”

- “You must spot opportunities and then manage risk.”

- “If you can predict tomorrow’s newspaper you’ll be very rich.”

- “If you sleep well, every night, there’s probably something wrong with you.”

- “These stocks have no memory. They do not care. They are there to make money.”

- “One of them has shit for brains and the other one cries for an hour and a half!”

Wisdom of Anton

- “You can spend a weekend thinking about a trade, walk in to the office and lose money.”

- “The daily news between 6am and 7:30am is crucial.”

- “When it comes to reading the news in the morning, you’ve got to be really military.”

- “I’ve seen mentally strong people become psychologically destroyed.”

- “There may be a public perception of what a trader is: loads of money, wild parties, drugs, women, going out all the time. I dare anyone to try this for a month. See how it affects your life.”

So, Should YOU Become a Day Trader?

For the right person, with the required skills and correct mindset, day trading could be a MASSIVE money maker.

Clearly it is not about just understanding the technology and being a geek.

As it happens, a former neighbour of mine did some trading and lost a lot of money. He made it all back, and then some. Does this tempt me? Not really.

It is clearly very difficult work and not recommended for someone who comes from a touchy feely customer service sort of background in a business. Cleo was a vet, accustomed to caring for injured animals. Those types of people are in for a shock if they go into a dog-eat-dog world like trading.

It is fair to say you *might* need to become a bit of a wanker who cares little for life and death because cashing in on a tragedy is often equated with success in the City. It’s just the way it is.

Also, you WILL need to improve your maths, instincts, confidence and knowledge of the world.

I Hate Maths

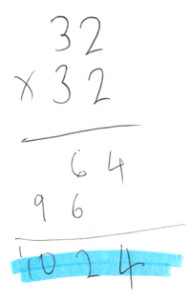

Admittedly, I am crap at maths and consider it my weakest subject. I would have failed the interview to become a trader because I do not know what 32 X 32 is off the top of my head.

Give me paper and pen and I can eventually tell you, but it’s probably important to be to make quick calculations in a fast paced environment like trading.

If you speak to experienced traders they will tell you the emotional and psychological skill set is AS important as mastering the technical understanding of the financial stuff.

There are a lot of sports psychology comparisons too.

In the other BBC series I mentioned earlier – Traders: Millions by the Minute – someone said it is like playing an important football match every day.

Think of it like this:

- Can you afford to lose regularly?

- Can you bounce back from defeat?

- Can you handle crushing disappointment?

Training Session Advice

- “There is no right way to trade. There is no rule book.”

- “What there IS, is different people finding what suits them and making money.”

- “Once you understand the rules of the game, the challenge is controlling your temperament.”

If you believe you meet the criteria, you could trade from home if you wanted, using desktop PC software or a phone app to keep tabs on the shares index.

The simulation technology is available for testing your trades. Try out a free £10,000 practice account for free using the link. I haven’t used this myself however, so tell me how you get on.

Required Traits of a Trader

- Unemotional

- Disciplined

- Good maths/mental arithmetic

- Single minded

- Selfish

- Early riser (up at 5am, working at 6am)

- Awareness of world news

- Good instincts

- Opportunist

- Certain attitude toward failure

- Creativity

- Able to take and manage risk

Short selling is not without its controversies. It has been blamed for the collapse of Wall Street in 1929 after trader Jesse Livermore shorted the market to make $100 million after public outrage ensued.

Honestly, I don’t think I should get involved in short selling, but I would like to play with some dummy market software to simulate the action. To see if I can pull off good theoretical trades. In other words, gambling with matchsticks instead of coins.

From a technological perceptive, we have today’s “big data” to drill into and analyse. Social media can tell us a lot about market mood.

A hedge fund was set up a few years ago when Twitter was used to successfully predict market behaviours by running advanced keyword searches to quantify feelings.

Note: At the time of writing this article (September 2014), the BBC are also showing a new series called Traders: Millions by the Minute. I’ve seen both parts and recommend you watch it too (Hint: try YouTube if the iPlayer no longer has it).

Now, back to my Warren Buffett book!

Oh me, Oh my.. this is like a mirror to me, I have experienced many of the emotions noted in this article.

I have been doing this for many years….. mainly Forex, I have often thought of switching to stocks, old habits are powerful.

A trader has to develop an ‘eye’ for what the price bars are telling him. He has to understand what the prior bar said and he has to understand what the past 50 bars collectively have said.

And the only way to learn is to replay the market over and over and over on a daily basis and learn to recognize the signals that you want to trade.

A trader needs only one signal, he has to master that signal, make it his own, own it, perfect it and focus on it alone. That is the key to riches in the markets.

Few people can do that….. they have not the determination, patience and disciple to stick with one or two setups……. they jump all over the place. they load their charts with indicators that become confusing. As soon as they add something to their initial setup they are toast and will lose their money.

So……… unless you have the ability for rigid self discipline and are prepared to review charts every night for a couple hours, best to buy lottery tickets to get your fortune.

I suppose you need to reconcile yourself in the knowledge that your trades might not be ethical too. I cannot imagine myself doing well at trading, not least because I don’t feel I have the time to put into it. Some of the people in the BBC program (Million Dollar Traders) were clearly trifling with matters they don’t understand just because they fancied making a bit of lolly.

Still, I’m curious to play with some sand-boxed simulation software where I can just trade with pretend money… kind of like playing poker with matchsticks or buttons.

Is there any such software Dave?

Sometimes I watch YouTube videos where people talk about their trades and share tips. I do not understand it all but I feel some of the concepts might be rubbing off on me a little.

How long have you been trading for?